Fed up with Debt?

We can help bring the smiles back. Debt Consolidation help in Nottingham.

Here are four great Nottingham debt solutions that could help you out of debt.

IVA's

FOR DEBTS OVER £7000

FOR DEBTS OVER £7000

An IVA can help you write off the debts you cannot afford. Debts that qualify for an IVA can be cleared in a set time period (usually 5 to 6 years).

An IVA is a legal process by which you can gain protection from your unsecured creditors by entering into a legally binding repayment agreement with them, which is then supervised by a licensed insolvency practitioner.

The good thing about an IVA is that it always lasts for a set time period, usually 60 months. After that, any leftover debts are written off – leaving you debt free and ready to make a fresh financial start

Also, interest and charges on your accounts are frozen and your creditors are completely barred from contacting you directly.

An IVA is a type of personal insolvency which is set up and managed by a licensed Insolvency Practitioner (IP). If you decide an IVA is the best way of dealing with your debts, we will refer you an IVA advisor who will get you started with that whole process.

Debt Management

FOR DEBTS OVER £2000

Debt Management allows you to pay one affordable monthly payment for all of your unsecured bank loans, credit card repayments and your other debts.

Firstly the hassle of dealing with your paperwork and and day-to-day dealings with your creditors is taken away. Secondly, we will look to negotiate the freezing of charges and interest on your accounts to help stop your debts increasing.

The key advantage is having one affordable monthly repayment to make which is paid to your creditors on your behalf. All communication between your creditors and yourselves will be handled, taking away the hassle of dealing with creditors. Once your primary living expenses have been included in your financial statement, you only pay what you can afford. This way, you can still pay those important bills and they look after the rest for you.

Debt Relief Orders (DRO) – For those with little spare income and non homeowners

A DRO is another formal legal process under the control of the Official Receiver for people with disposable income, assets, and debts all below certain limits.

Debt Relief Order (DRO) is a personal insolvency process.

DROs are one way to deal with your debts if you owe less than £30,000, don’t have much spare income and don’t own your home.

A DRO is available to people meeting certain criteria, so eligibility will depend upon your overall circumstances. If you are eligible, and DRO is your preferred option, then we will refer you to an authorised intermediary for further assistance.

Bankruptcy – For those with little or no disposable income

If you are facing bankruptcy then it is important to speak to a professional debt advisor before proceeding with bankruptcy.

Debt Advice Online was set up to deal specifically with cases of serious debt that require immediate expert help. Advice is given both on avoiding declaring Bankruptcy and also how to go through the whole bankruptcy process. After speaking to a professional debt advisor, you may find that Bankruptcy might not be the right solution for you and there are better alternatives. Either way, we will help you decide which debt solution is the most suitable for you.

Bankruptcy is the long - established formal legal process for writing off unmanageable debt. This process is under the control of the Official Receiver.

Which debts are worrying you?

We can help get you financially unstuck.

Here's an example of how an IVA can help

Imagine you have the following debts:

Loan 1 |

£11,152 |

Loan 2 |

£2,226 |

Loan 3 |

£302 |

Credit card 1 |

£2,395 |

Credit card 2 |

£648 |

Council Tax |

£172 |

Payday loan |

£1,408 |

Total amount owed: |

£18,303 |

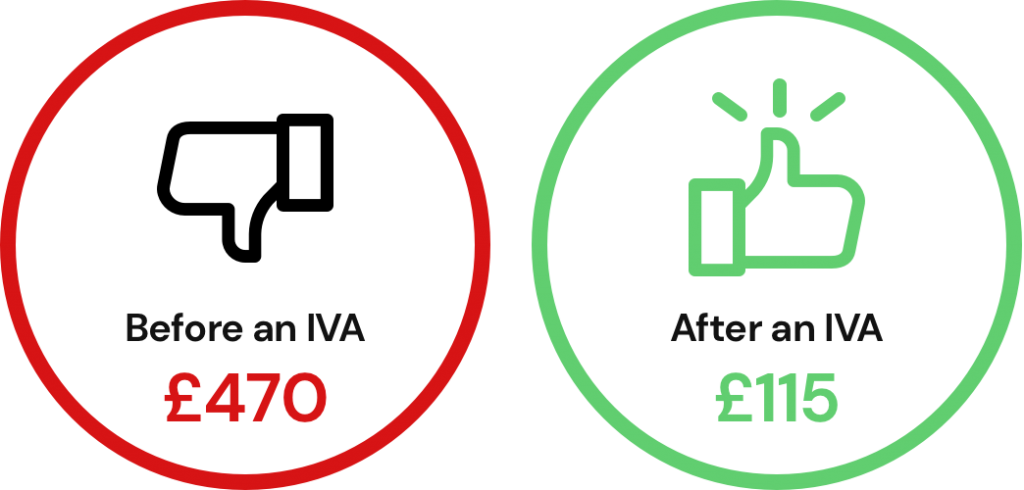

Customer repayments before & after an IVA

Reduced by 80%

* monthly payments are based on individual financial circumstances

Limitations

Creditors are not obliged to agree to a Debt Management Plan nor freeze interest and charges.

Sometimes rescheduling your Debt payments can lead to an increase in the total sum repaid and can extend your repayment period. Debt advisors should advise you an estimate for the total repayment period and length of time for the plan subject to your creditors accepting the arrangements.

Failure to keep up your repayments once on a repayment plan may result in arrangements with your creditors to be broken.

Your credit rating is likely to be affected by all the debt solutions we offer.

We have been helping thousands of people just like you.

This is a guide from GOV.UK with options for paying off your debts as recommended by the Money Helper.

Our opening hours

Monday to Thursday: 08:00 – 19:00

Friday: 08:00 – 16:00

Call: 0161 xxxxxxx